Rows: 10,000

Columns: 55

$ emp_title <chr> "global config engineer ", "warehouse…

$ emp_length <dbl> 3, 10, 3, 1, 10, NA, 10, 10, 10, 3, 1…

$ state <fct> NJ, HI, WI, PA, CA, KY, MI, AZ, NV, I…

$ homeownership <fct> MORTGAGE, RENT, RENT, RENT, RENT, OWN…

$ annual_income <dbl> 90000, 40000, 40000, 30000, 35000, 34…

$ verified_income <fct> Verified, Not Verified, Source Verifi…

$ debt_to_income <dbl> 18.01, 5.04, 21.15, 10.16, 57.96, 6.4…

$ annual_income_joint <dbl> NA, NA, NA, NA, 57000, NA, 155000, NA…

$ verification_income_joint <fct> , , , , Verified, , Not Verified, , ,…

$ debt_to_income_joint <dbl> NA, NA, NA, NA, 37.66, NA, 13.12, NA,…

$ delinq_2y <int> 0, 0, 0, 0, 0, 1, 0, 1, 1, 0, 0, 0, 0…

$ months_since_last_delinq <int> 38, NA, 28, NA, NA, 3, NA, 19, 18, NA…

$ earliest_credit_line <dbl> 2001, 1996, 2006, 2007, 2008, 1990, 2…

$ inquiries_last_12m <int> 6, 1, 4, 0, 7, 6, 1, 1, 3, 0, 4, 4, 8…

$ total_credit_lines <int> 28, 30, 31, 4, 22, 32, 12, 30, 35, 9,…

$ open_credit_lines <int> 10, 14, 10, 4, 16, 12, 10, 15, 21, 6,…

$ total_credit_limit <int> 70795, 28800, 24193, 25400, 69839, 42…

$ total_credit_utilized <int> 38767, 4321, 16000, 4997, 52722, 3898…

$ num_collections_last_12m <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ num_historical_failed_to_pay <int> 0, 1, 0, 1, 0, 0, 0, 0, 0, 0, 1, 0, 0…

$ months_since_90d_late <int> 38, NA, 28, NA, NA, 60, NA, 71, 18, N…

$ current_accounts_delinq <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ total_collection_amount_ever <int> 1250, 0, 432, 0, 0, 0, 0, 0, 0, 0, 0,…

$ current_installment_accounts <int> 2, 0, 1, 1, 1, 0, 2, 2, 6, 1, 2, 1, 2…

$ accounts_opened_24m <int> 5, 11, 13, 1, 6, 2, 1, 4, 10, 5, 6, 7…

$ months_since_last_credit_inquiry <int> 5, 8, 7, 15, 4, 5, 9, 7, 4, 17, 3, 4,…

$ num_satisfactory_accounts <int> 10, 14, 10, 4, 16, 12, 10, 15, 21, 6,…

$ num_accounts_120d_past_due <int> 0, 0, 0, 0, 0, 0, 0, NA, 0, 0, 0, 0, …

$ num_accounts_30d_past_due <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ num_active_debit_accounts <int> 2, 3, 3, 2, 10, 1, 3, 5, 11, 3, 2, 2,…

$ total_debit_limit <int> 11100, 16500, 4300, 19400, 32700, 272…

$ num_total_cc_accounts <int> 14, 24, 14, 3, 20, 27, 8, 16, 19, 7, …

$ num_open_cc_accounts <int> 8, 14, 8, 3, 15, 12, 7, 12, 14, 5, 8,…

$ num_cc_carrying_balance <int> 6, 4, 6, 2, 13, 5, 6, 10, 14, 3, 5, 3…

$ num_mort_accounts <int> 1, 0, 0, 0, 0, 3, 2, 7, 2, 0, 2, 3, 3…

$ account_never_delinq_percent <dbl> 92.9, 100.0, 93.5, 100.0, 100.0, 78.1…

$ tax_liens <int> 0, 0, 0, 1, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ public_record_bankrupt <int> 0, 1, 0, 0, 0, 0, 0, 0, 0, 0, 1, 0, 0…

$ loan_purpose <fct> moving, debt_consolidation, other, de…

$ application_type <fct> individual, individual, individual, i…

$ loan_amount <int> 28000, 5000, 2000, 21600, 23000, 5000…

$ term <dbl> 60, 36, 36, 36, 36, 36, 60, 60, 36, 3…

$ interest_rate <dbl> 14.07, 12.61, 17.09, 6.72, 14.07, 6.7…

$ installment <dbl> 652.53, 167.54, 71.40, 664.19, 786.87…

$ grade <ord> C, C, D, A, C, A, C, B, C, A, C, B, C…

$ sub_grade <fct> C3, C1, D1, A3, C3, A3, C2, B5, C2, A…

$ issue_month <fct> Mar-2018, Feb-2018, Feb-2018, Jan-201…

$ loan_status <fct> Current, Current, Current, Current, C…

$ initial_listing_status <fct> whole, whole, fractional, whole, whol…

$ disbursement_method <fct> Cash, Cash, Cash, Cash, Cash, Cash, C…

$ balance <dbl> 27015.86, 4651.37, 1824.63, 18853.26,…

$ paid_total <dbl> 1999.330, 499.120, 281.800, 3312.890,…

$ paid_principal <dbl> 984.14, 348.63, 175.37, 2746.74, 1569…

$ paid_interest <dbl> 1015.19, 150.49, 106.43, 566.15, 754.…

$ paid_late_fees <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…Visualizing categorical data (and more aesthetics)

Intro to Data Analytics

Visualizing categorical data

Data: Lending Club

Thousands of loans made through the Lending Club, a platform that allows individuals to lend to other individuals

Not all loans are created equal – ease of getting a loan depends on (apparent) ability to pay back the loan.

Data includes loans made, these are not loan applications

A peek at data

Selected variables

loans <- loans_full_schema %>%

select(loan_amount, interest_rate, term, grade,

state, annual_income, homeownership, debt_to_income)

glimpse(loans)Rows: 10,000

Columns: 8

$ loan_amount <int> 28000, 5000, 2000, 21600, 23000, 5000, 24000, 20000, 20…

$ interest_rate <dbl> 14.07, 12.61, 17.09, 6.72, 14.07, 6.72, 13.59, 11.99, 1…

$ term <dbl> 60, 36, 36, 36, 36, 36, 60, 60, 36, 36, 60, 60, 36, 60,…

$ grade <ord> C, C, D, A, C, A, C, B, C, A, C, B, C, B, D, D, D, F, E…

$ state <fct> NJ, HI, WI, PA, CA, KY, MI, AZ, NV, IL, IL, FL, SC, CO,…

$ annual_income <dbl> 90000, 40000, 40000, 30000, 35000, 34000, 35000, 110000…

$ homeownership <fct> MORTGAGE, RENT, RENT, RENT, RENT, OWN, MORTGAGE, MORTGA…

$ debt_to_income <dbl> 18.01, 5.04, 21.15, 10.16, 57.96, 6.46, 23.66, 16.19, 3…Selected variables

| variable | description |

|---|---|

loan_amount |

Amount of loan, in US dollars |

interest_rate |

Loan interest rate, in annual percentage |

term |

Loan length, in whole number of months |

grade |

Loan grade, values A through G, likelihood of being repaid |

state |

US state where borrower resides |

annual_income |

Borrower’s annual income, including any second income (USD) |

homeownership |

Indicates whether person owns, owns but has mortgage, or rents their home |

debt_to_income |

Debt-to-income ratio |

Variable types

| variable | type |

|---|---|

loan_amount |

numerical, continuous |

interest_rate |

numerical, continuous |

term |

numerical, discrete |

grade |

categorical, ordinal |

state |

categorical, not ordinal |

annual_income |

numerical, continuous |

homeownership |

categorical, not ordinal |

debt_to_income |

numerical, continuous |

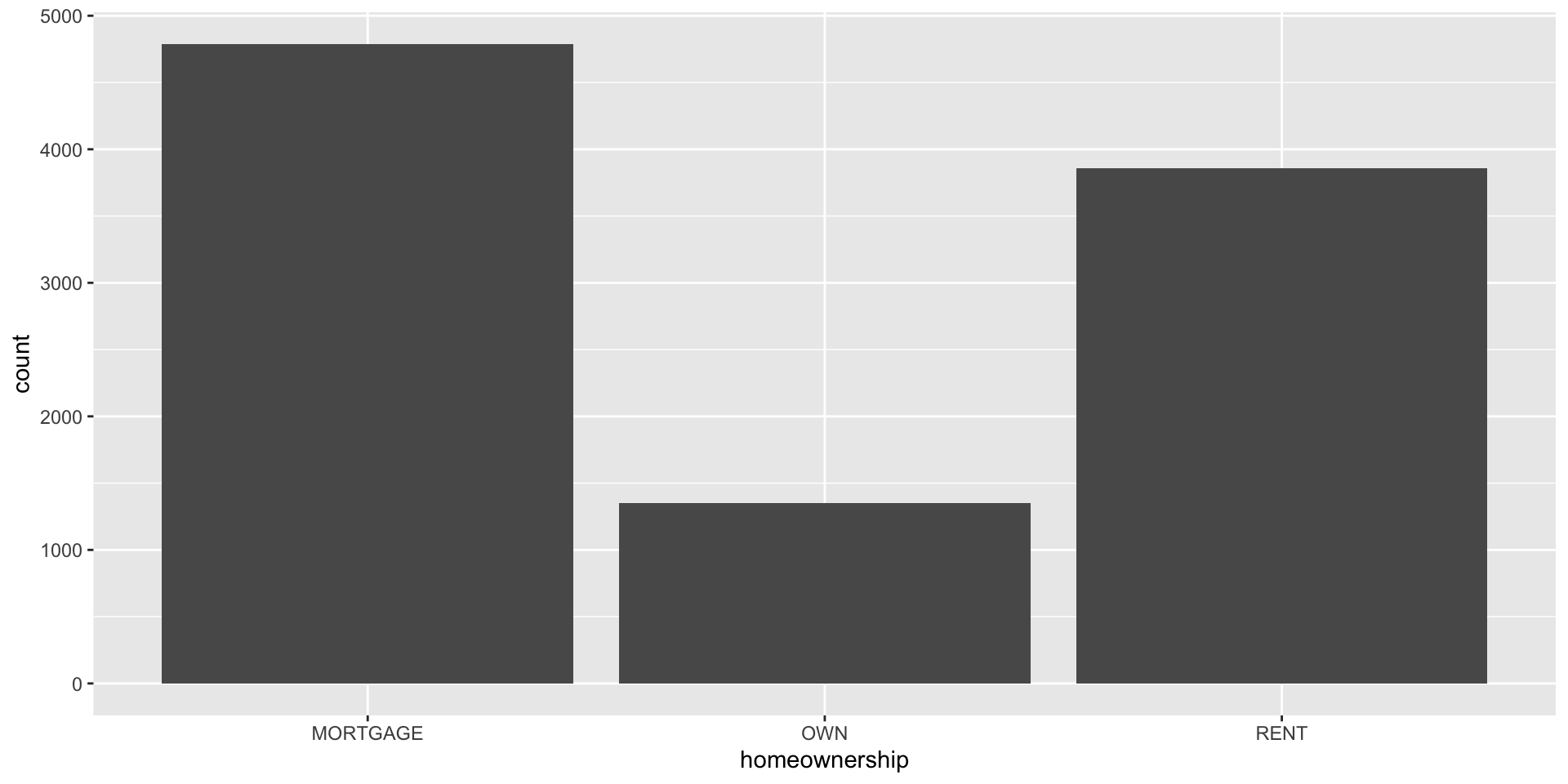

Bar plot

Bar plot

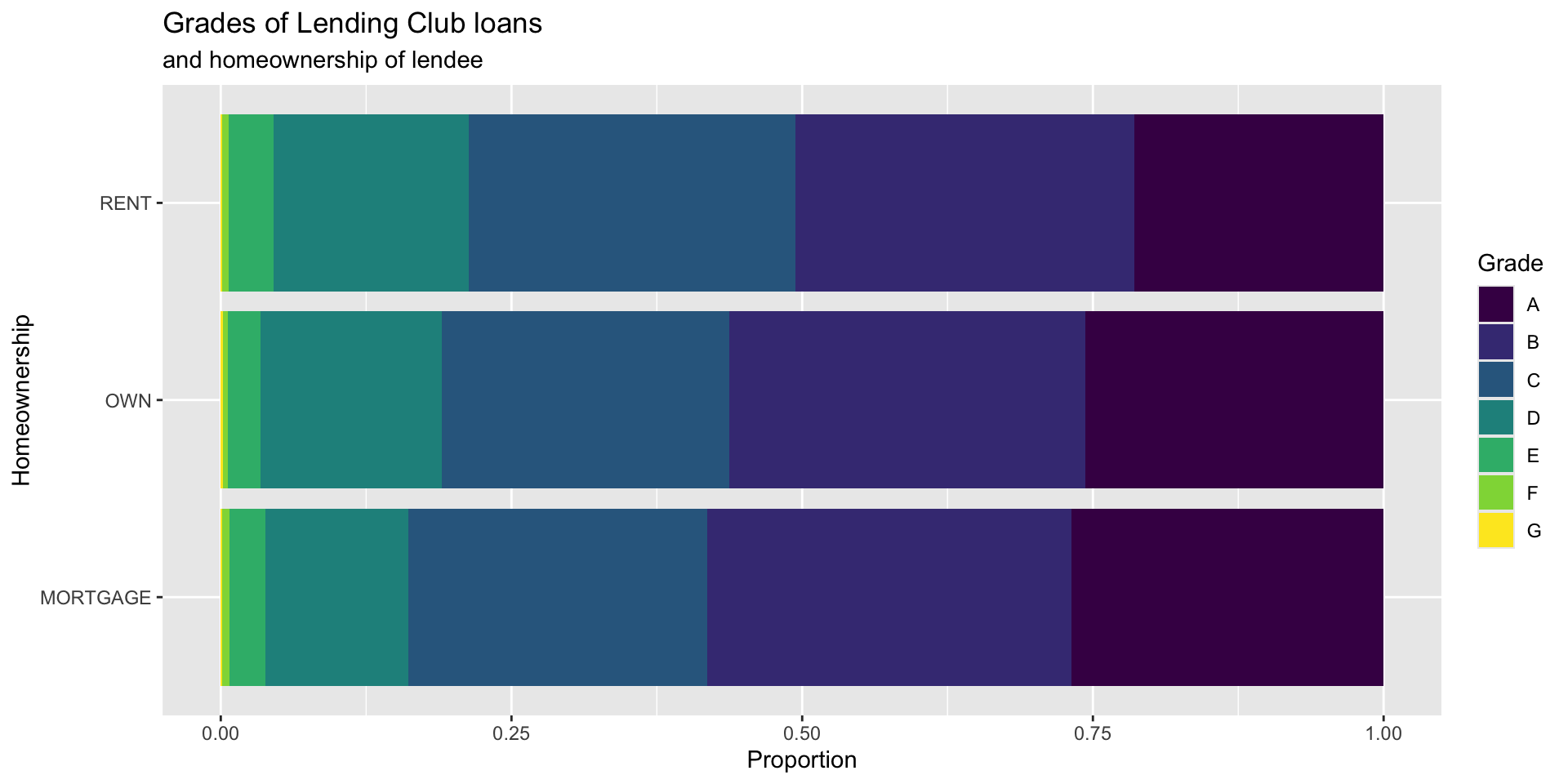

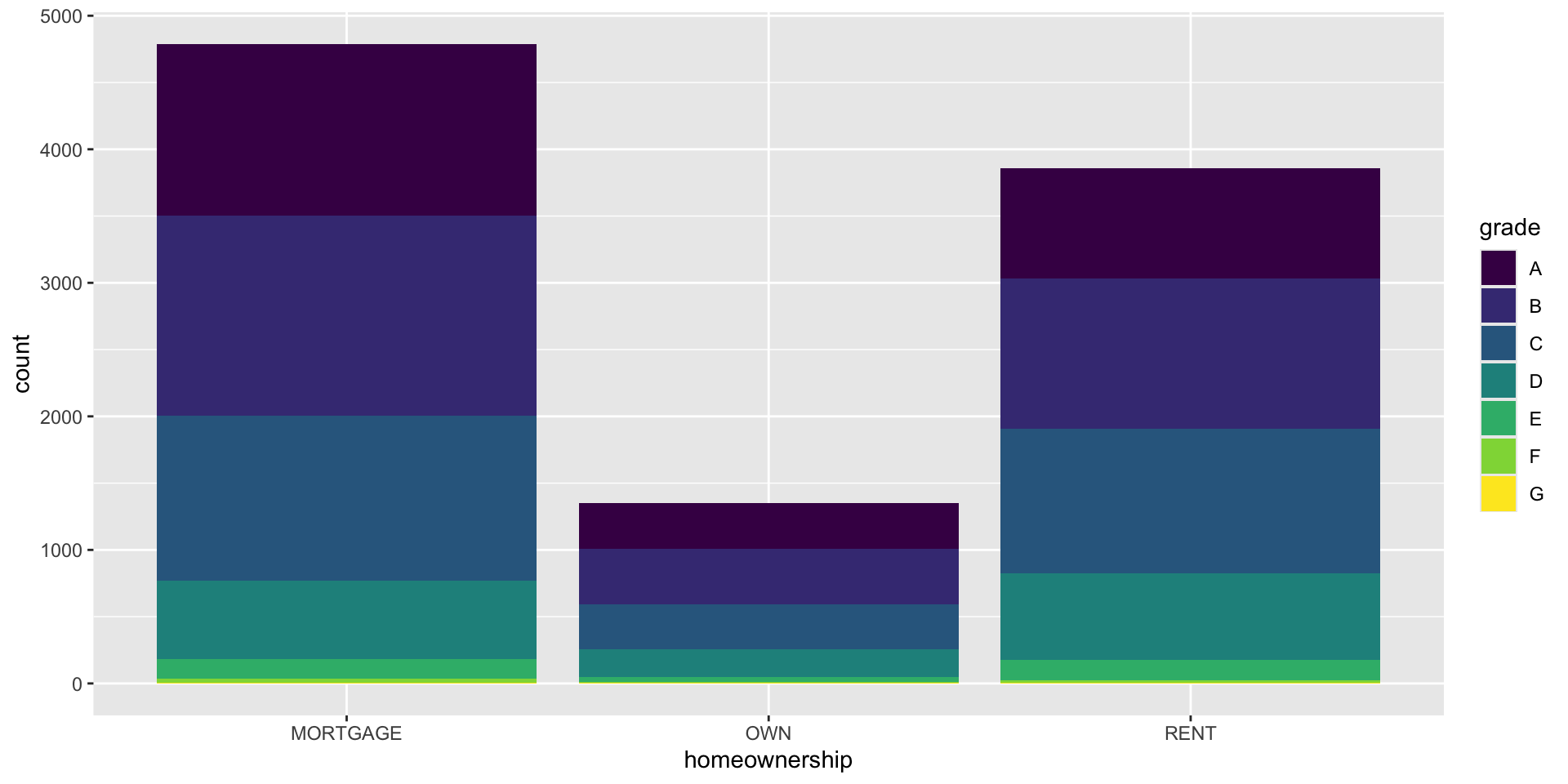

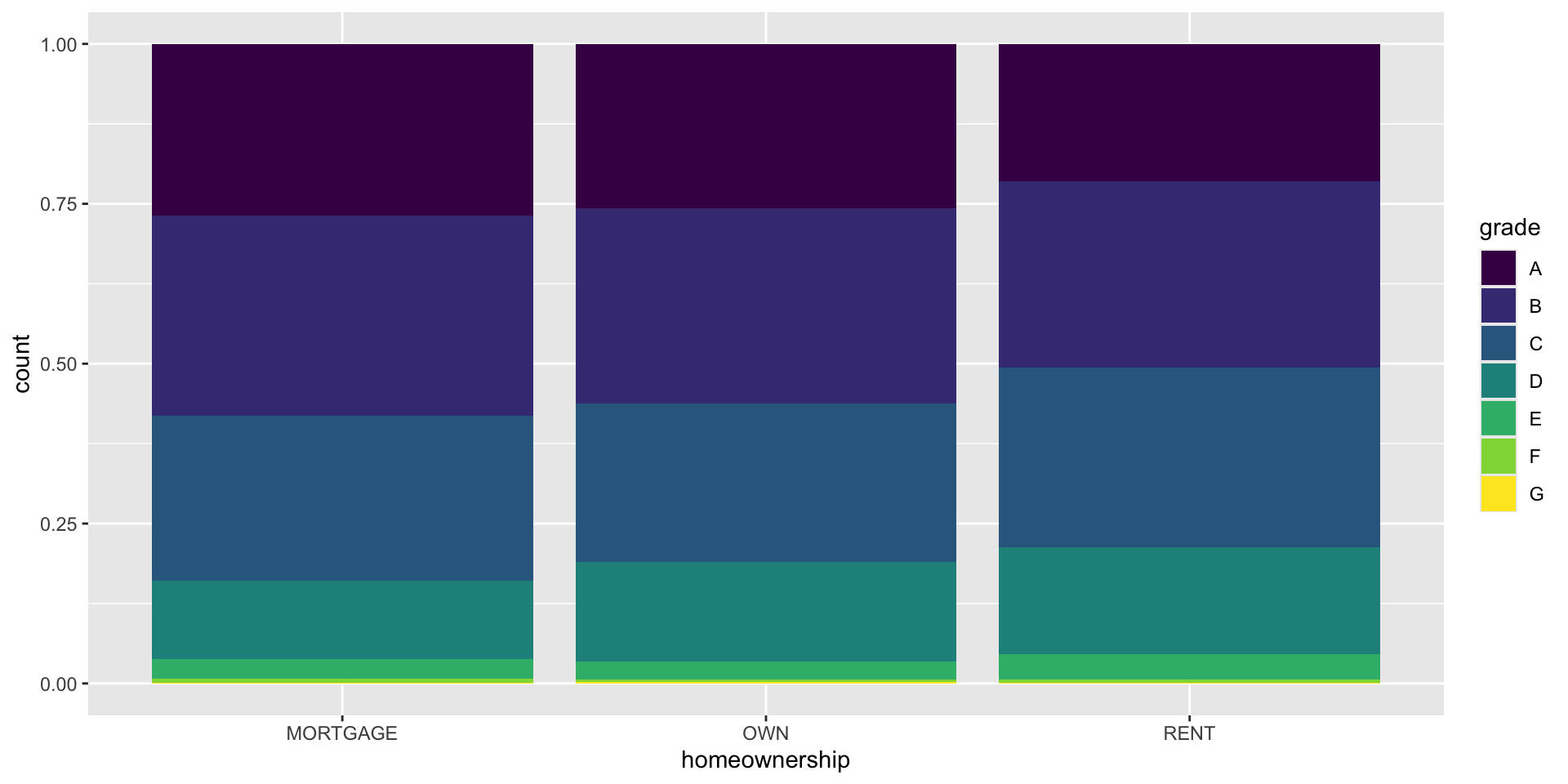

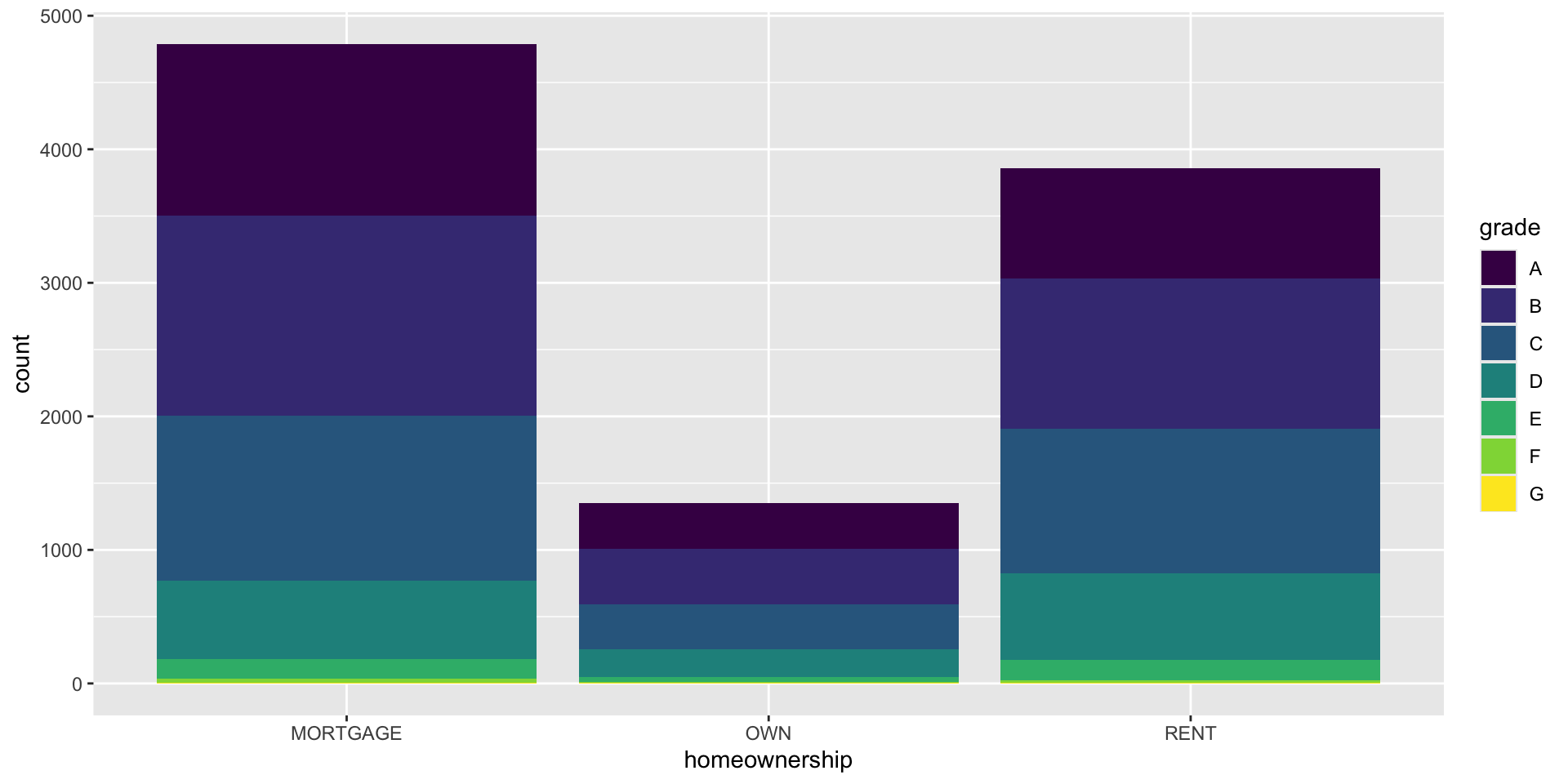

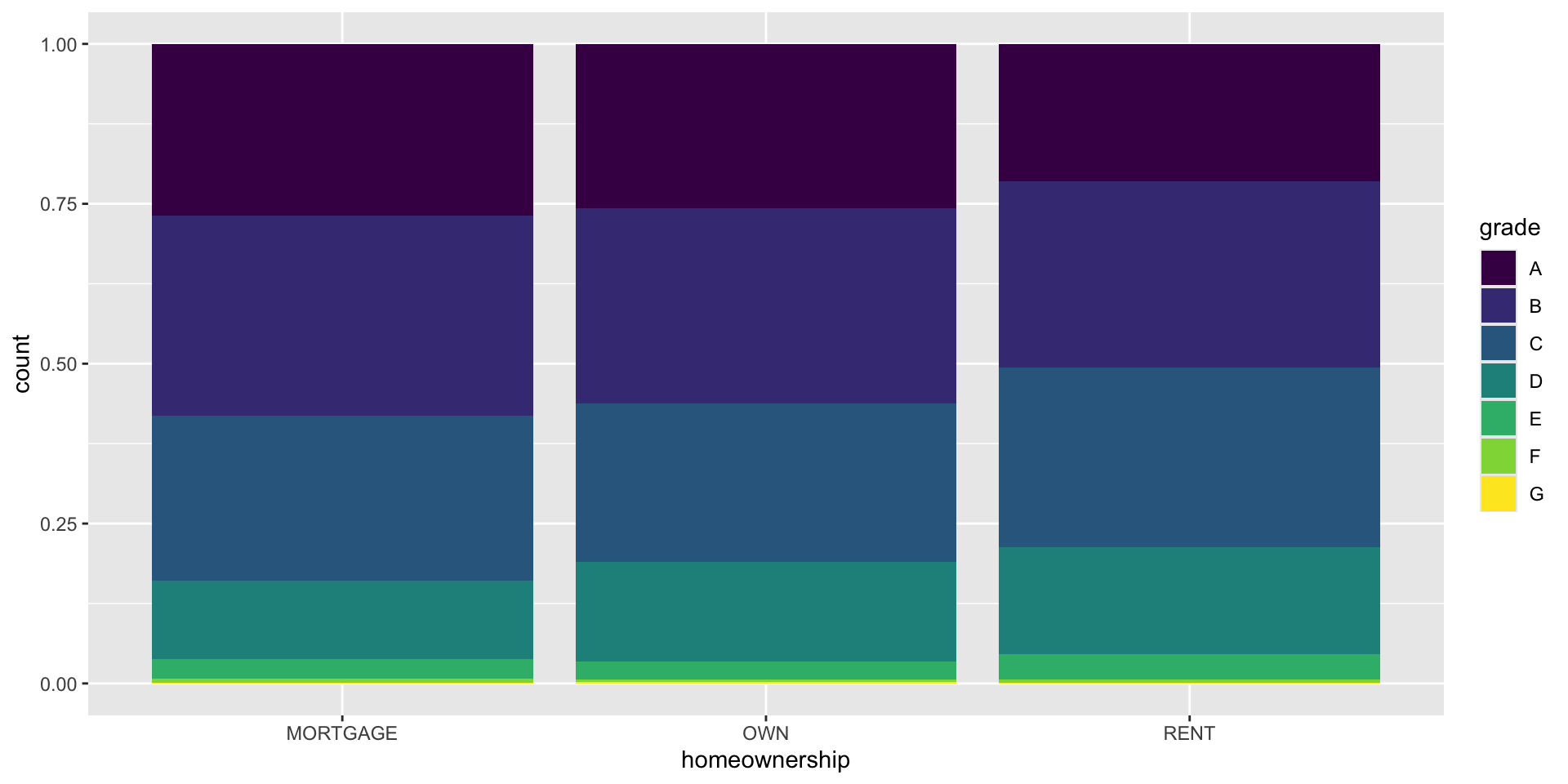

Segmented bar plot

Segmented bar plot

Show proportion.

Bar Plot

Which is a more useful representation for visualizing relationship btwn homeownership and loan grade?

Customizing bar plots

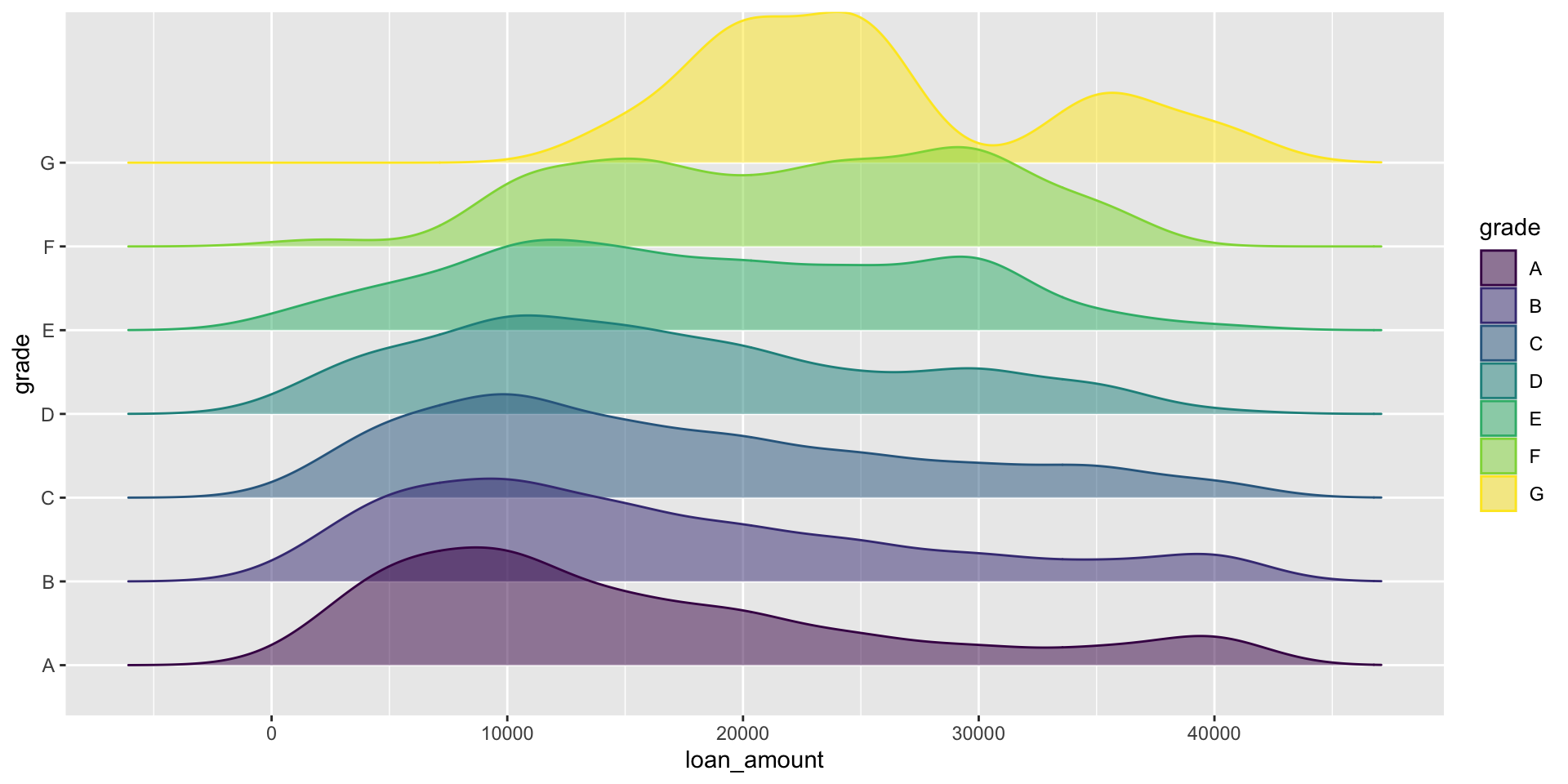

Relationships between numerical and categorical variables

Already talked about…

- Coloring and faceting histograms and density plots

- Side-by-side box plots

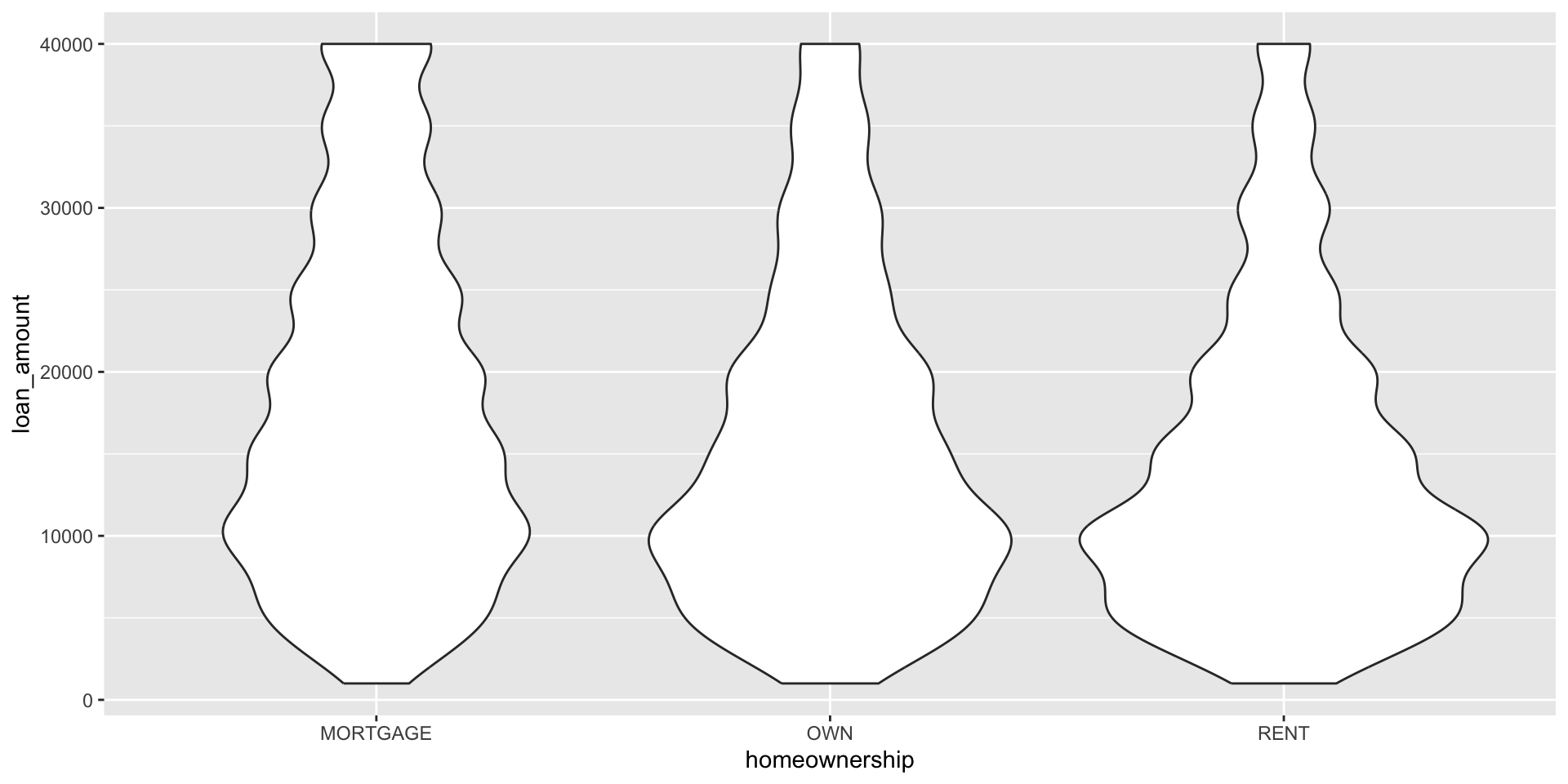

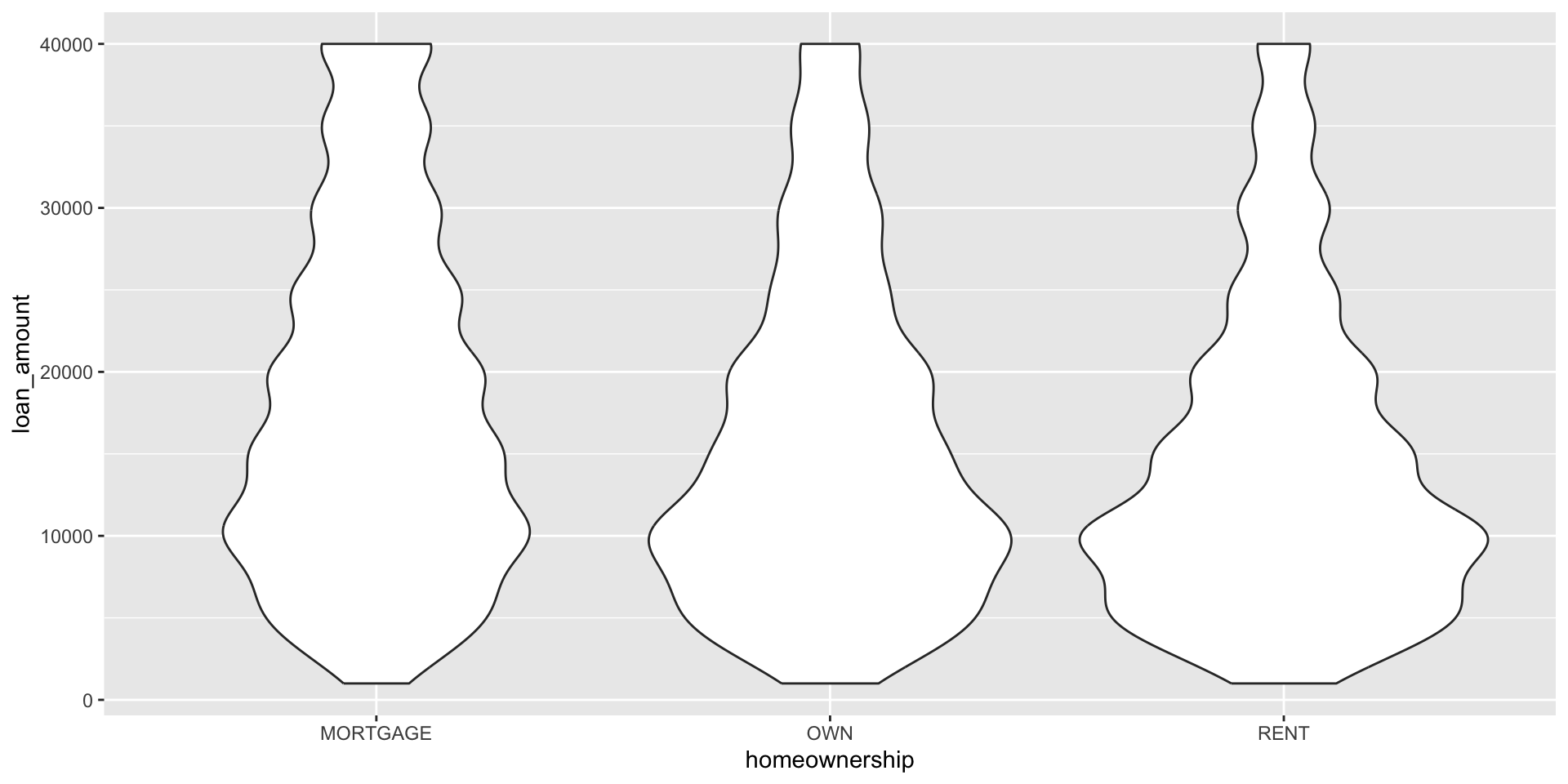

Violin plots

- combine side by side box plots with density plots

Violin plots

- Shows peaks in the data

- For multimodal distributions (those with multiple peaks)

Learn more:

Violin plots

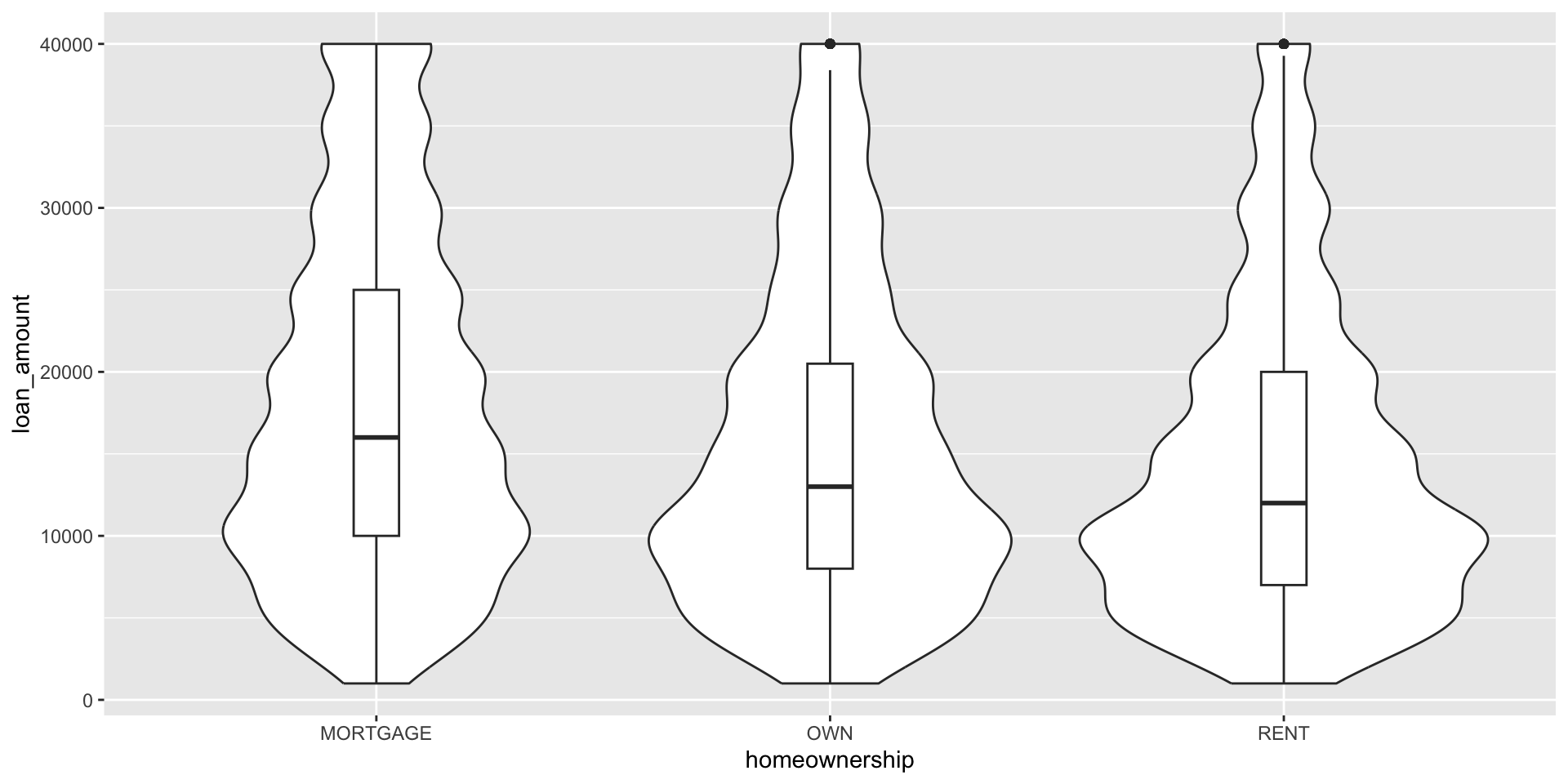

We can add more information to our violin plots to communicate more about the numerical distribution. In the plot below we add a boxplot within the violin.

Why did we choose a box plot in this case? What about the distributions shown in the violin geom point us towards displaying the median and IQR?

Ridge plots